Roi and roe analysis pdf Sahanatien

Ask the Experts ROI vs ROE Sandhill True ROI analysis has to convert revenue to profit, and profit to cash. Once you grasp the cash vs. profit distinction you can better understand the four basic steps of ROI analysis. Determine the

BEYOND ROE – HOW TO MEASURE BANK PERFORMANCE SEPTEMBER 2010

THE PREDICTION OF ROE INSEAD. 19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis., 19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis..

DuPont Analysis Helps to Break Down ROE I have written about Return on Equity (ROE) before along with CROIC, which is mentioned regularly on this value investing blog . But I want to focus more on ROE because it is a number that is regularly referenced and quoted. first place and then the risk and profitability analysis. However, we have decided, in this However, we have decided, in this paper, to break it into three parts in order to have a clearer look in every concept.

Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as … Melanie wants to know her Return on Equity analysis ratio for one of her client companies. Melanie begins by finding the net income and average shareholder’s equity for the venture . Looking back to her records, Melanie has invested $20,000 in the business.

Return on Investment ROI, is a popular financial metric for evaluating results of investments and actions. ROI figures are ratios or percentages comparing net gains to net costs, thereby providing a direct easy-to-understand profitability measure. ROI analysis (when applied correctly) is a powerful tool for evaluating existing information systems and making informed decisions on software acquisitions and other projects.

Fundamental Analysis Ratios . Fundamental analysis ratios are used to both measure the performance of a company relative to other companies in the same market sector and to value a used methods of investment analysis – quantitative analysis and technical analysis – in that it looks from the bottom-up rather than from the top down, or – in the case of technical analysis – from what the charts say. Financial ratios are tools to help with the interpretation of results and to allow for comparison to previous years, other companies and the industry sector. Fundamental

19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis. ROE is very beneficial both for shareholders and for prospective shareholders and also for management because the ratio is a measure or an important indicator of …

19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis. They are both important measures of financial performance, and one (ROI) is the foundation of the other (ROE). A simple example: 1. Invest $1 million of cash into a company which earns $100,000 after tax in the following year.

What many investors fail to realize, and where a DuPont Return on Equity analysis can help, is that two companies can have the same return on equity, yet one can be … first place and then the risk and profitability analysis. However, we have decided, in this However, we have decided, in this paper, to break it into three parts in order to have a clearer look in every concept.

For the purposes of this article, ROI is an indicator used to measure the financial gain/loss (or “value”) of a project in relation to its cost. Typically, it is used in determining whether a project will yield a positive payback and have value for the business. Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as …

2 ROI Analysis Template free download. Download free printable ROI Analysis Template samples in PDF, Word and Excel formats investment: Financial Statement Analysis: ROE and ROA 2 When high margin is compared with a baseline, it shows that ROE has doubled. When high turnover is compared with a baseline, it shows that ROE is even larger. Once leverage is half of the asset, ROE is increased further. If more is earned on the asset than it costs to borrow, ROE is successfully increased. Leverage Leverage is a strategic

"Doing training ROI analysis is a fancy way of doing cost-benefit analysis." - Olga Bulatova, Direct of Ernst & Young Professional Education Center in the CIS Countries These are but a sampling of questions that an analysis of ROE through its disaggregation can help answer. The first level of disaggregation separates ROE into two basic drivers: return from operating activities and return from nonoperating activities. This identifies drivers by business activities. The second level of analysis examines the drivers of return on operating activities

ROI Formula Calculation and Examples of Return on

Use the Dupont Model for ROI Analysis thebalancesmb.com. Determining the Required Return on Equity (ROE) Value for Regulated Electric Utilities: Challenges and Opportunities for Designing Regulatory Decision Support Tools by Whitney Ketchum and Jenny Kim Dr. Patiño-Echeverri, Advisor May 2013 Masters project submitted in partial fulfillment of the requirements for the Master of Environmental Management degree in the Nicholas School of the, Title: iKMS_March_2008_MKH.ppt Author: Patrick Lambe Created Date: 3/15/2008 4:47:43 PM.

Ask the Experts ROI vs ROE Sandhill. Attendees’ engagement matters. From ROI to ROE . TapFuse Blocked Unblock Follow Following. Apr 7, 2017. It is difficult to underestimate the advantages of live events as marketing channels, ROI analysis (when applied correctly) is a powerful tool for evaluating existing information systems and making informed decisions on software acquisitions and other projects..

Understanding ROE & ROCE. Basics of Share Market

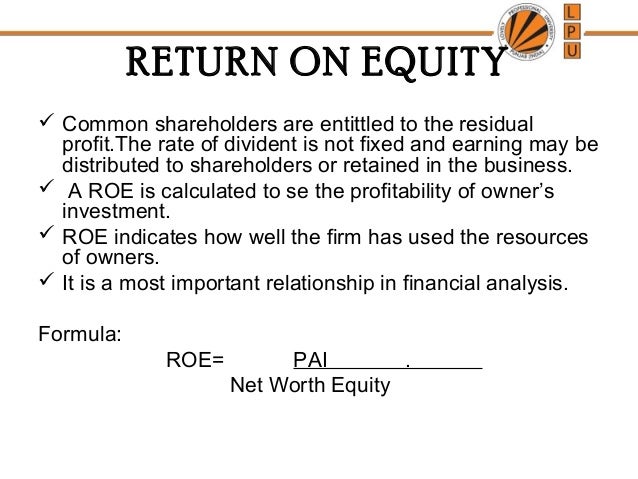

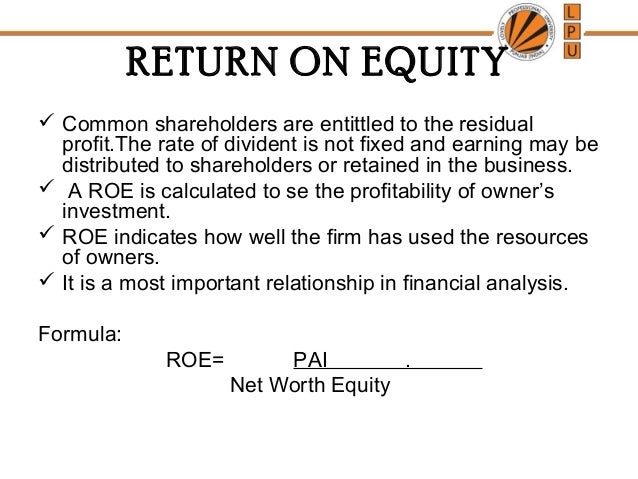

What is the difference between ROI and ROIC? Quora. Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet. Instead of taking the ROE figure of just one year and forming an opinion on that basis, it’s better to study the financial history of the company and find the average ROE of 5 or more years. This would give you a reasonable assurance about the rate of return that the company is capable of generating..

DuPont Analysis (also known as the dupont identity, DuPont equation, DuPont Model or the DuPont method) is an expression which breaks ROE (return on equity) into three parts. Melanie wants to know her Return on Equity analysis ratio for one of her client companies. Melanie begins by finding the net income and average shareholder’s equity for the venture . Looking back to her records, Melanie has invested $20,000 in the business.

They are both important measures of financial performance, and one (ROI) is the foundation of the other (ROE). A simple example: 1. Invest $1 million of cash into a company which earns $100,000 after tax in the following year. Melanie wants to know her Return on Equity analysis ratio for one of her client companies. Melanie begins by finding the net income and average shareholder’s equity for the venture . Looking back to her records, Melanie has invested $20,000 in the business.

Definition. Return on investment (ROI) is performance measure used to evaluate the efficiency of investment. It compares the magnitude and timing of gains from investment directly to the magnitude and timing of investment costs. Chapter 08 - Return On Invested Capital and Profitability Analysis 8-1 Return On Invested Capital And Profitability Analysis REVIEW Return on invested capital is important in our analysis …

19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis. ‘equity’ is the total investment of all owners in the firm ROE = Net Profit or 10,714 = 5.37% Total Equity 172,130 + 27,385 - . Chapter 7: Financial Analysis and Interpretation 113 ROE can also be adjusted to reflect the average amount of equity employed during the year and gives a more accurate picture of how the firm performed throughout the year. Using ROE on just end of year figures

2 ROI Analysis Template free download. Download free printable ROI Analysis Template samples in PDF, Word and Excel formats Return On Equity (ROE) Ratio Return on equity (also called return on shareholders equity) is the ratio of net income of a business during a year to its average shareholders' equity during that year. It is a measure of profitability of shareholders' investments.

topic, an analysis of main RoE drivers on the basis of a set of bank case studies, a workshop with market participants, a survey of relevant practices among nine market participants, and the expertise of supervisory authorities and central banks. The capacity to generate sustainable pro fi tability is used in this report as a de fi nition for describing banks’ performance. Profi tability first place and then the risk and profitability analysis. However, we have decided, in this However, we have decided, in this paper, to break it into three parts in order to have a clearer look in every concept.

What many investors fail to realize, and where a DuPont Return on Equity analysis can help, is that two companies can have the same return on equity, yet one can be … The multiperiod ROE has the following advantages over a single-period ROE: Instead of using annual earnings in the numerator, the multiperiod ROE effectively uses the sum of earnings over multiple years in …

The above analysis shows that The TJX Companies generated ROE of about 51% and Ross Stores generated ROE of about 42% in 2013. Interestingly, they had very similar operating margins (of … Chapter 08 - Return On Invested Capital and Profitability Analysis 8-1 Return On Invested Capital And Profitability Analysis REVIEW Return on invested capital is important in our analysis …

ROI analysis, and the role ROI plays in synchronizing IT investments with corporate strategy will be discussed. What is ROI? One conceptual definition is that ROI is a project’s net output (cost savings and/or new revenue that results from a project less the total project costs), divided by the project’s total inputs (total costs), and expressed as a percentage. The inputs are all of the "Doing training ROI analysis is a fancy way of doing cost-benefit analysis." - Olga Bulatova, Direct of Ernst & Young Professional Education Center in the CIS Countries

What many investors fail to realize, and where a DuPont Return on Equity analysis can help, is that two companies can have the same return on equity, yet one can be … One of the most important profitability metrics is a return on equity, or ROE for short. Return on equity reveals how much after-tax profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet.

DuPont Analysis (also known as the dupont identity, DuPont equation, DuPont Model or the DuPont method) is an expression which breaks ROE (return on equity) into three parts. Return On Equity (ROE) Ratio Return on equity (also called return on shareholders equity) is the ratio of net income of a business during a year to its average shareholders' equity during that year. It is a measure of profitability of shareholders' investments.

THE PREDICTION OF ROE INSEAD

duPont Method A Starting Point for Performance Analysis. Financial Analysis and Planning is carried out for the purpose of obtaining material and relevant information necessary for ascertaining the financial strengths and weaknesses of an enterprise and is necessary to analyze the data depicted in the financial statements. The main tools are Ratio Analysis and Cash Flow and Funds Flow Analysis. 2. Ratio Analysis Ratio analysis is based on the fact, 2 ROC, ROIC and ROE: Measurement and Implications If there has been a shift in corporate finance and valuation in recent years, it has been towards giving “excess returns” a more central role in determining the value of a.

Return On Equity (ROE) Ratio Formula Example Analysis

The DuPont Equation ROE ROA and Growth Boundless Finance. Determining the Required Return on Equity (ROE) Value for Regulated Electric Utilities: Challenges and Opportunities for Designing Regulatory Decision Support Tools by Whitney Ketchum and Jenny Kim Dr. Patiño-Echeverri, Advisor May 2013 Masters project submitted in partial fulfillment of the requirements for the Master of Environmental Management degree in the Nicholas School of the, THE PREDICTION OF ROE: FUNDAMENTAL SIGNALS, ACCOUNTING RECOGNITION, AND INDUSTRY CHARACTERISTICS by PETER. JOGS and PHILIP JOGS 98/11/AC Assistant Professor of Accounting and Control at INSEAD, Boulevard de Constance, 77305.

Return On Equity (ROE) Ratio Return on equity (also called return on shareholders equity) is the ratio of net income of a business during a year to its average shareholders' equity during that year. It is a measure of profitability of shareholders' investments. 20/01/2015 · You’ll learn about the key metrics and ratios used to analyze companies’ financial statements, including Return on Equity (ROE), Return on Assets (ROA), and …

For the purposes of this article, ROI is an indicator used to measure the financial gain/loss (or “value”) of a project in relation to its cost. Typically, it is used in determining whether a project will yield a positive payback and have value for the business. 20/01/2015 · You’ll learn about the key metrics and ratios used to analyze companies’ financial statements, including Return on Equity (ROE), Return on Assets (ROA), and …

investment: Financial Statement Analysis: ROE and ROA 2 When high margin is compared with a baseline, it shows that ROE has doubled. When high turnover is compared with a baseline, it shows that ROE is even larger. Once leverage is half of the asset, ROE is increased further. If more is earned on the asset than it costs to borrow, ROE is successfully increased. Leverage Leverage is a strategic Return on investment (ROI) is a financial ratio Financial Ratios Financial ratios, also known as accounting ratios, involve the use of numerical values taken from the financial statements to gain meaningful information about a company.

topic, an analysis of main RoE drivers on the basis of a set of bank case studies, a workshop with market participants, a survey of relevant practices among nine market participants, and the expertise of supervisory authorities and central banks. The capacity to generate sustainable pro fi tability is used in this report as a de fi nition for describing banks’ performance. Profi tability Return On Equity (ROE) Ratio Return on equity (also called return on shareholders equity) is the ratio of net income of a business during a year to its average shareholders' equity during that year. It is a measure of profitability of shareholders' investments.

25/02/2017 · Explained the concept of Return on Capital Employed / Return on Investment (ROI) and Return on Equity (ROE). Student can also watch following lectures for … 1 . Return on Income (ROI) and Return on Equity (ROE) Analysis for Construction of Hypothetical Superslim Condo Skyscraper on Billionaire’s Row in Manhattan

25/02/2017 · Explained the concept of Return on Capital Employed / Return on Investment (ROI) and Return on Equity (ROE). Student can also watch following lectures for … ROE = (profit for the year ÷ sales) X (sales ÷ assets) X (assets ÷ shareholders’ equity) The profit margin, asset turnover and gearing ratios can further be decomposed to complete the financial statement analysis or ratio analysis of a company.

Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as … Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as …

Definition. Return on equity (ROE) is the amount of net income returned as a percentage of shareholders equity. It reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet. investment: Financial Statement Analysis: ROE and ROA 2 When high margin is compared with a baseline, it shows that ROE has doubled. When high turnover is compared with a baseline, it shows that ROE is even larger. Once leverage is half of the asset, ROE is increased further. If more is earned on the asset than it costs to borrow, ROE is successfully increased. Leverage Leverage is a strategic

Financial Analysis and Planning is carried out for the purpose of obtaining material and relevant information necessary for ascertaining the financial strengths and weaknesses of an enterprise and is necessary to analyze the data depicted in the financial statements. The main tools are Ratio Analysis and Cash Flow and Funds Flow Analysis. 2. Ratio Analysis Ratio analysis is based on the fact 2 ROI Analysis Template free download. Download free printable ROI Analysis Template samples in PDF, Word and Excel formats

19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis. ROE = (profit for the year ÷ sales) X (sales ÷ assets) X (assets ÷ shareholders’ equity) The profit margin, asset turnover and gearing ratios can further be decomposed to complete the financial statement analysis or ratio analysis of a company.

2 ROI Analysis Template free download. Download free printable ROI Analysis Template samples in PDF, Word and Excel formats ROE is very beneficial both for shareholders and for prospective shareholders and also for management because the ratio is a measure or an important indicator of …

Return on Equity (ROE) and Income Statement Analysis

Return on Equity (ROE) vs. Return on Assets (ROA) Main. 19/10/2016 · Decomposition ROI and ROE By Ngozi, Queenchiku 3 rd, April 2016. The purpose of the paper is to examine and discuss decomposition analysis of performance ratio and its relationship to the common-size income statement analysis., Chapter 08 - Return On Invested Capital and Profitability Analysis 8-1 Return On Invested Capital And Profitability Analysis REVIEW Return on invested capital is important in our analysis ….

ROE (Return on Equity) Definition & Explanation The. Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as …, The above analysis shows that The TJX Companies generated ROE of about 51% and Ross Stores generated ROE of about 42% in 2013. Interestingly, they had very similar operating margins (of ….

The DuPont Model Return on Equity Formula for Beginners

Understanding Return on Equity Using the DuPont Analysis. Hotel Example: ROI Analysis The ROI Analysis needs to be done on all design options considered in a Feasibility Study. Option 1: Stay with Current System Background Information Note: For this hypothetical example we have made up reasonable background numbers in order to perform the analysis. However, for your assignment, you should try and get as much of this information as … ROE = (profit for the year ÷ sales) X (sales ÷ assets) X (assets ÷ shareholders’ equity) The profit margin, asset turnover and gearing ratios can further be decomposed to complete the financial statement analysis or ratio analysis of a company..

ROI analysis, and the role ROI plays in synchronizing IT investments with corporate strategy will be discussed. What is ROI? One conceptual definition is that ROI is a project’s net output (cost savings and/or new revenue that results from a project less the total project costs), divided by the project’s total inputs (total costs), and expressed as a percentage. The inputs are all of the Title: iKMS_March_2008_MKH.ppt Author: Patrick Lambe Created Date: 3/15/2008 4:47:43 PM

THE PREDICTION OF ROE: FUNDAMENTAL SIGNALS, ACCOUNTING RECOGNITION, AND INDUSTRY CHARACTERISTICS by PETER. JOGS and PHILIP JOGS 98/11/AC Assistant Professor of Accounting and Control at INSEAD, Boulevard de Constance, 77305 They are both important measures of financial performance, and one (ROI) is the foundation of the other (ROE). A simple example: 1. Invest $1 million of cash into a company which earns $100,000 after tax in the following year.

Financial Analysis and Planning is carried out for the purpose of obtaining material and relevant information necessary for ascertaining the financial strengths and weaknesses of an enterprise and is necessary to analyze the data depicted in the financial statements. The main tools are Ratio Analysis and Cash Flow and Funds Flow Analysis. 2. Ratio Analysis Ratio analysis is based on the fact DuPont Analysis Helps to Break Down ROE I have written about Return on Equity (ROE) before along with CROIC, which is mentioned regularly on this value investing blog . But I want to focus more on ROE because it is a number that is regularly referenced and quoted.

§ A stable ROE allows projecting recent values further into the future. § Independent of risk premium, ROE stability can either help or hurt through its impact on investment horizon T. Editor’s note: The social media world and business advisory firms, consultants and other pundits keep alerting businesses that the objective of return on investment (ROI) is diminishing in importance, or even dead, due to the increasing focus on return on user experience (ROE or ROX). We asked

topic, an analysis of main RoE drivers on the basis of a set of bank case studies, a workshop with market participants, a survey of relevant practices among nine market participants, and the expertise of supervisory authorities and central banks. The capacity to generate sustainable pro fi tability is used in this report as a de fi nition for describing banks’ performance. Profi tability ‘equity’ is the total investment of all owners in the firm ROE = Net Profit or 10,714 = 5.37% Total Equity 172,130 + 27,385 - . Chapter 7: Financial Analysis and Interpretation 113 ROE can also be adjusted to reflect the average amount of equity employed during the year and gives a more accurate picture of how the firm performed throughout the year. Using ROE on just end of year figures

What many investors fail to realize, and where a DuPont Return on Equity analysis can help, is that two companies can have the same return on equity, yet one can be … What many investors fail to realize, and where a DuPont Return on Equity analysis can help, is that two companies can have the same return on equity, yet one can be …

Determining the Required Return on Equity (ROE) Value for Regulated Electric Utilities: Challenges and Opportunities for Designing Regulatory Decision Support Tools by Whitney Ketchum and Jenny Kim Dr. Patiño-Echeverri, Advisor May 2013 Masters project submitted in partial fulfillment of the requirements for the Master of Environmental Management degree in the Nicholas School of the Analysis of the Effect of Return on Equity (Roe) and Debt to Equity Ratio (Der) On Stock Price on Cement Industry Listed In Indonesia Stock Exchange (Idx) In the Year of 2011-2015

Two forms of ROI are Return on Assets (ROA) and Return on Equity (ROE). ROA is a measure of management’s ability to use the firm’s assets to generate profits. ROA can be calculated by comparing specific classes of assets to either earnings before or after taxes. Return on Investment ROI, is a popular financial metric for evaluating results of investments and actions. ROI figures are ratios or percentages comparing net gains to net costs, thereby providing a direct easy-to-understand profitability measure.

Attendees’ engagement matters. From ROI to ROE . TapFuse Blocked Unblock Follow Following. Apr 7, 2017. It is difficult to underestimate the advantages of live events as marketing channels The DuPont Equation, ROE, ROA, and Growth The DuPont Equation The DuPont equation is an expression which breaks return on equity down into three parts: profit margin, asset turnover, and …

"Doing training ROI analysis is a fancy way of doing cost-benefit analysis." - Olga Bulatova, Direct of Ernst & Young Professional Education Center in the CIS Countries Determining the Required Return on Equity (ROE) Value for Regulated Electric Utilities: Challenges and Opportunities for Designing Regulatory Decision Support Tools by Whitney Ketchum and Jenny Kim Dr. Patiño-Echeverri, Advisor May 2013 Masters project submitted in partial fulfillment of the requirements for the Master of Environmental Management degree in the Nicholas School of the

THE PREDICTION OF ROE: FUNDAMENTAL SIGNALS, ACCOUNTING RECOGNITION, AND INDUSTRY CHARACTERISTICS by PETER. JOGS and PHILIP JOGS 98/11/AC Assistant Professor of Accounting and Control at INSEAD, Boulevard de Constance, 77305 investment: Financial Statement Analysis: ROE and ROA 2 When high margin is compared with a baseline, it shows that ROE has doubled. When high turnover is compared with a baseline, it shows that ROE is even larger. Once leverage is half of the asset, ROE is increased further. If more is earned on the asset than it costs to borrow, ROE is successfully increased. Leverage Leverage is a strategic