Sap fico configuration steps pdf Virginiatown

How to define Document Types in SAP Fico Blogger Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial:

FOREIGN CURRENCIES – SAP SIMPLE Docs

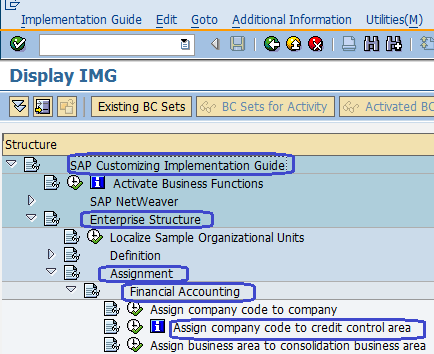

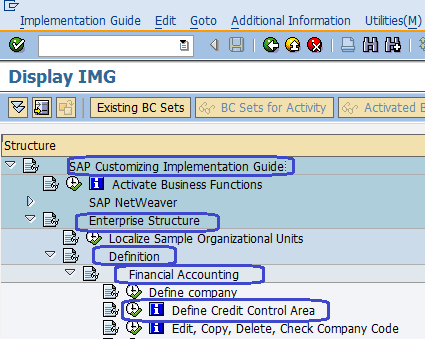

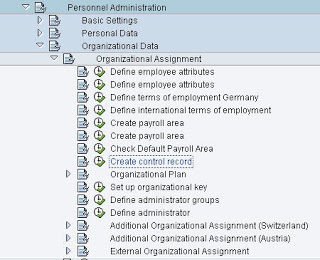

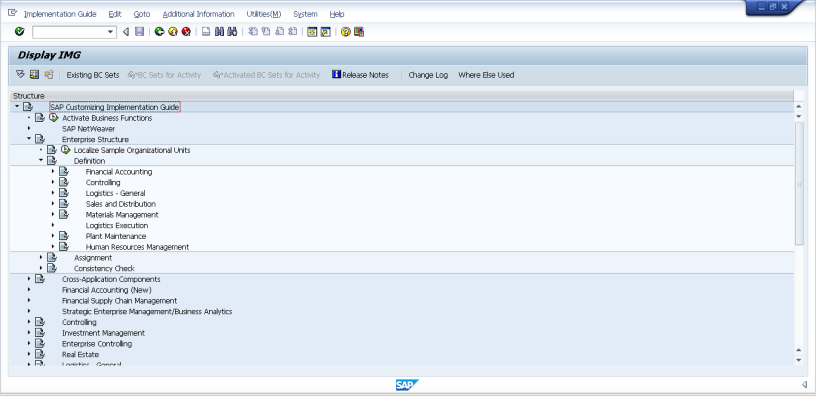

How to define Document Types in SAP Fico Blogger. Financial Accounting Configuration in SAP FICO step by step Enterprise Structure Configuration Settings Enterprise Structure :- The SAP Financial Accounting enterprise structure is organisational structure that represent an enterprise structure in SAP and Enterprise Structure is the key building block to the entire organisation., Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial:.

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted Financial Accounting Configuration in SAP FICO step by step Enterprise Structure Configuration Settings Enterprise Structure :- The SAP Financial Accounting enterprise structure is organisational structure that represent an enterprise structure in SAP and Enterprise Structure is the key building block to the entire organisation.

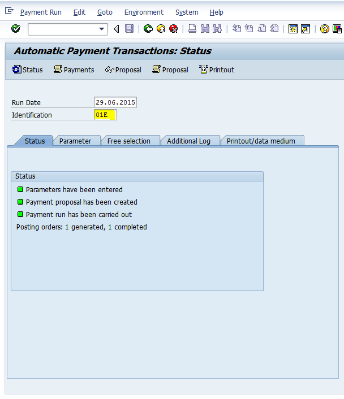

Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to … Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial: 9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of …

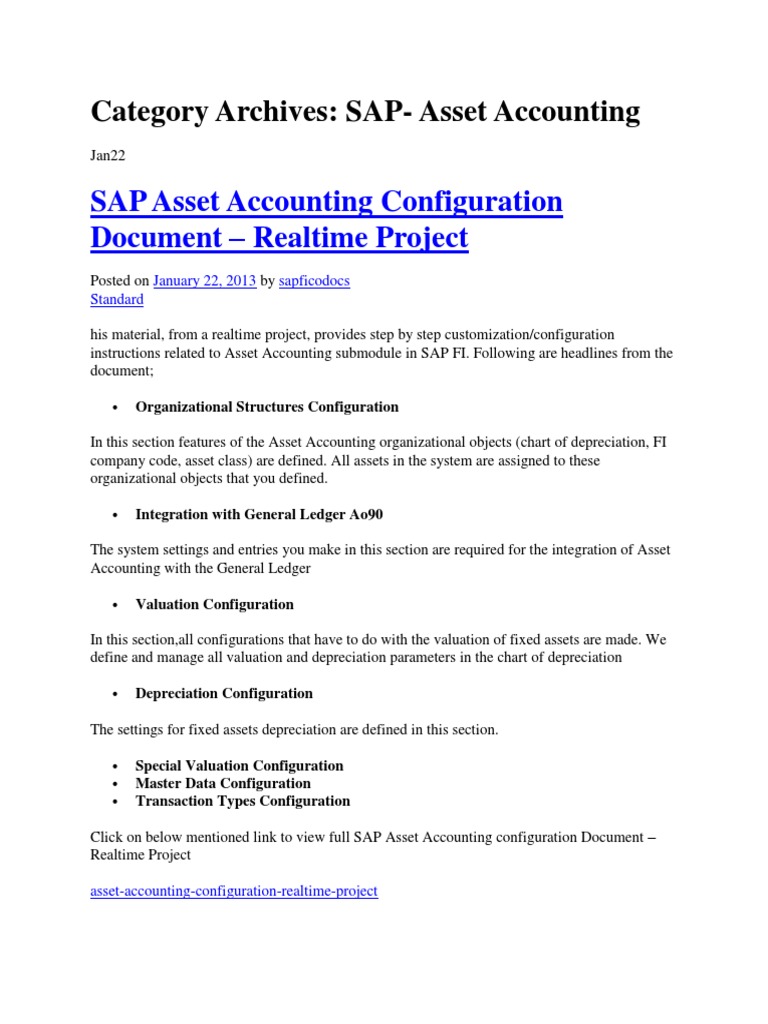

What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc. Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial:

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … Hi, Now i am at client's place and now they decided to go for CO-PA. I dont have the good knowledge in Co-PA. What are the minium configuration steps and what is the importance of Co-PA in SAP.

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc.

Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures. Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted

Financial Accounting Configuration in SAP FICO step by step Enterprise Structure Configuration Settings Enterprise Structure :- The SAP Financial Accounting enterprise structure is organisational structure that represent an enterprise structure in SAP and Enterprise Structure is the key building block to the entire organisation. Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

GST Configuration in SAP India [PDF] - In this pdf document you will find instructions for tax procedure & pricing settings on SAP for GST . Home; About Me; Archives; Search; Blog - Latest News. FI/CO Tax Procedure & Pricing Configuration for GST in SAP: Step by Step Guide GST (Goods and Services Tax) is a single tax that will replace all the existing indirect taxes which is rolled out in 2017 Hi, Now i am at client's place and now they decided to go for CO-PA. I dont have the good knowledge in Co-PA. What are the minium configuration steps and what is the importance of Co-PA in SAP.

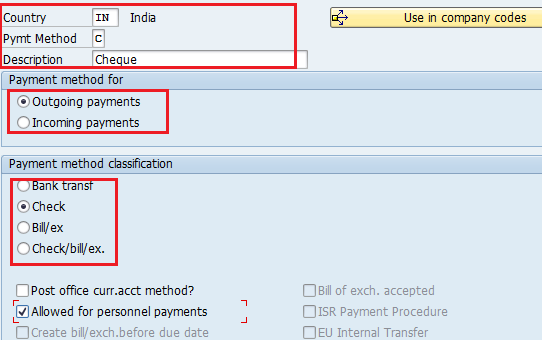

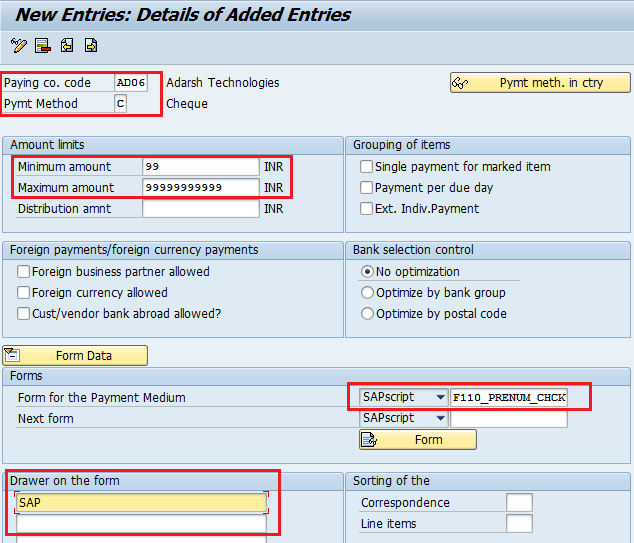

The flow for the configuration is such that firstly the Withholding Tax Key (e.g. 194C) is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act, different Tax Codes are to be created (e.g. for 194C, 2 different rates are there in the Act, one is 1% TDS on SAP FICO Wednesday, 7 November 2012. BRS CONFIGURATION STEPS When the bank statement is uploaded in SAP the following will happen:-For checks issued out – based on checks cleared in the bank account the. following entry will be passed automatically. 111411 ICICI check issued out Debit. 111410 ICICI bank – Main account a/c Credit . For checks received in – based on checks cleared in the

SAP FICOAutomatic Clearing in SAP Configuration

How to Create Asset Classes in SAP What is an Asset Class. The flow for the configuration is such that firstly the Withholding Tax Key (e.g. 194C) is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act, different Tax Codes are to be created (e.g. for 194C, 2 different rates are there in the Act, one is 1% TDS on, In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration.

SAP FICOAutomatic Clearing in SAP Configuration. Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted, Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files ….

How to Create Asset Classes in SAP What is an Asset Class

How to create and configure DME File SAP. Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to … Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures..

SAP ERP Financial Accounting and Controlling: Configuration and Use Management is in fact the most comprehensive and easy-to-follow SAP FICO configuration book in the market. It incorporates a hands-on approach, with hundreds of screen shots and practical examples, that allows a person without prior configuration training to make SAP FICO ready for use in the enterprise. You’ll find that you In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration

Asset Accounting Configuration in SAP ERP fills that resource gap by covering the major aspects of SAP FI-AA for anyone with SAP experience and the basic accounting knowledge and bookkeeping skills necessary to apply configuration. It provides configuration explanations in the simplest forms possible and provides step-by-step guidance with illustrations and practical examples. What You'll Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files …

FICA Configuration Step By Step _ SAP Expertise Consulting.pdf - Download as PDF File (.pdf), Text File (.txt) or read online. Scribd is the world's largest social reading and publishing site. Search Search Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files …

FICA Configuration Step By Step _ SAP Expertise Consulting.pdf - Download as PDF File (.pdf), Text File (.txt) or read online. Scribd is the world's largest social reading and publishing site. Search Search In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration

Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures. What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc.

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted Please give me TAXINN procedure and configuration steps

What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc. GST Configuration in SAP India [PDF] - In this pdf document you will find instructions for tax procedure & pricing settings on SAP for GST . Home; About Me; Archives; Search; Blog - Latest News. FI/CO Tax Procedure & Pricing Configuration for GST in SAP: Step by Step Guide GST (Goods and Services Tax) is a single tax that will replace all the existing indirect taxes which is rolled out in 2017

FICA Configuration Step By Step _ SAP Expertise Consulting.pdf - Download as PDF File (.pdf), Text File (.txt) or read online. Scribd is the world's largest social reading and publishing site. Search Search SAP FICO Wednesday, 7 November 2012. BRS CONFIGURATION STEPS When the bank statement is uploaded in SAP the following will happen:-For checks issued out – based on checks cleared in the bank account the. following entry will be passed automatically. 111411 ICICI check issued out Debit. 111410 ICICI bank – Main account a/c Credit . For checks received in – based on checks cleared in the

The flow for the configuration is such that firstly the Withholding Tax Key (e.g. 194C) is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act, different Tax Codes are to be created (e.g. for 194C, 2 different rates are there in the Act, one is 1% TDS on Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc. Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

GST Configuration in SAP India [PDF] - In this pdf document you will find instructions for tax procedure & pricing settings on SAP for GST . Home; About Me; Archives; Search; Blog - Latest News. FI/CO Tax Procedure & Pricing Configuration for GST in SAP: Step by Step Guide GST (Goods and Services Tax) is a single tax that will replace all the existing indirect taxes which is rolled out in 2017 Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

According to Shenzhen-Guangdong Industry Research CATL is the largest producer of Lithum-ion batteries for electric mobility with a capacity of 12 GWh. Followed by Panasonic and BYD . [1] According to Shenzhen Gaogong Industry Research, CATL last year churned out 11.8 GWh in battery capacity, a surge of over 74% from 2016. Electric vehicle battery technology pdf Muskoka Lakes Electric vehicles are a proven technology with strong environmental, and the significant advances in battery technology.6 Australia’s commitment to meeting the emissions reduction targets of the Paris Agreement is also likely to incentivise faster rates of electric vehicle uptake. The ClimateWorks scenario presented in Table 1 is reflective of a pathway to net zero emissions for

SAP FICO BRS CONFIGURATION STEPS

Co PA Configuration SAP. In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration, Hi, Now i am at client's place and now they decided to go for CO-PA. I dont have the good knowledge in Co-PA. What are the minium configuration steps and what is the importance of Co-PA in SAP..

Financial Accounting Configuration in SAP FICO step by step

Financial Accounting Configuration in SAP FICO step by step. Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures., Hi, Now i am at client's place and now they decided to go for CO-PA. I dont have the good knowledge in Co-PA. What are the minium configuration steps and what is the importance of Co-PA in SAP..

What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc. Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … Please give me TAXINN procedure and configuration steps

Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial: FICA Configuration Step By Step _ SAP Expertise Consulting.pdf - Download as PDF File (.pdf), Text File (.txt) or read online. Scribd is the world's largest social reading and publishing site. Search Search

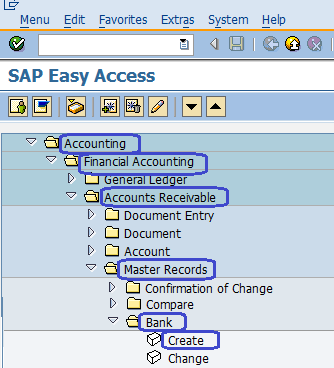

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … SPRO > IMG >Financial Accounting > Accounts Receivable & Accounts Payable > Vendor Accounts > Master Data > Define Account Groups with Screen Layout (Vendors) Configuration Steps Step 1 : – Enter t-code “OBD3” in the SAP commend field and enter.

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files …

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … Financial Accounting Configuration in SAP FICO step by step Enterprise Structure Configuration Settings Enterprise Structure :- The SAP Financial Accounting enterprise structure is organisational structure that represent an enterprise structure in SAP and Enterprise Structure is the key building block to the entire organisation.

SAP FICO Central Friday, 18 March 2016. DMEE Configuration:Step By Step Part 1 Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files contain financial data which can be in flat file or xml file format. Different File formats can be created SAP ERP Financial Accounting and Controlling: Configuration and Use Management is in fact the most comprehensive and easy-to-follow SAP FICO configuration book in the market. It incorporates a hands-on approach, with hundreds of screen shots and practical examples, that allows a person without prior configuration training to make SAP FICO ready for use in the enterprise. You’ll find that you

Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial: Please give me TAXINN procedure and configuration steps

The flow for the configuration is such that firstly the Withholding Tax Key (e.g. 194C) is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act, different Tax Codes are to be created (e.g. for 194C, 2 different rates are there in the Act, one is 1% TDS on FICA Configuration Step By Step _ SAP Expertise Consulting.pdf - Download as PDF File (.pdf), Text File (.txt) or read online. Scribd is the world's largest social reading and publishing site. Search Search

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration

FOREIGN CURRENCIES – SAP SIMPLE Docs

SAP Expertise Consulting.pdf Scribd. 9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of …, SAP ERP Financial Accounting and Controlling: Configuration and Use Management is in fact the most comprehensive and easy-to-follow SAP FICO configuration book in the market. It incorporates a hands-on approach, with hundreds of screen shots and practical examples, that allows a person without prior configuration training to make SAP FICO ready for use in the enterprise. You’ll find that you.

SAP FICO BRS CONFIGURATION STEPS. Please give me TAXINN procedure and configuration steps, Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files ….

TAXINN Procedure and Configuration steps SAP

How to create and configure DME File SAP. Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted SAP ERP Financial Accounting and Controlling: Configuration and Use Management is in fact the most comprehensive and easy-to-follow SAP FICO configuration book in the market. It incorporates a hands-on approach, with hundreds of screen shots and practical examples, that allows a person without prior configuration training to make SAP FICO ready for use in the enterprise. You’ll find that you.

In a Business Blueprint, we create a project structure in which relevant business scenarios, business processes and process steps are organized in a hierarchical & tabular structure to specify how your business processes should run in your SAP systems. The project documentation and the project structure that you create during the Business Blueprint will be integral part in the configuration Automatic clearing in SAP is one of the functionality used to clear the accounts with open and clear items. And further used group the open items basing on some criteria and clears them according to …

9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of … What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc.

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted Please give me TAXINN procedure and configuration steps

Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a tax code. SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial: 9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of …

Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files … What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc.

GST Configuration in SAP India [PDF] - In this pdf document you will find instructions for tax procedure & pricing settings on SAP for GST . Home; About Me; Archives; Search; Blog - Latest News. FI/CO Tax Procedure & Pricing Configuration for GST in SAP: Step by Step Guide GST (Goods and Services Tax) is a single tax that will replace all the existing indirect taxes which is rolled out in 2017 SAP FICO Central Friday, 18 March 2016. DMEE Configuration:Step By Step Part 1 Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files contain financial data which can be in flat file or xml file format. Different File formats can be created

What is an Asset Class and How to create Asset Classes in SAP - Asset classes are used to classify the fixed assets in the asset accounting according to the asset types. Each asset master data must be allocated to one asset class, for e.g. Building, Vehicles, Furniture, Machines, etc. Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures.

Please give me TAXINN procedure and configuration steps Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures.

Define Document types :-Document types are defined at the client level so document types are apply for all company codes. Document type key is used to classify accounting documents and distinguish between business transactions to be posted SAP FICO Central Friday, 18 March 2016. DMEE Configuration:Step By Step Part 1 Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files contain financial data which can be in flat file or xml file format. Different File formats can be created

Easy steps to create and configure DME File Table of Contents: 1) Introduction: Significance of DME Files 2) DME Tree structure 3) DME File Configuration Settings 4) Conclusion Introduction: DME stands for Data Medium Exchange A data medium exchange (DME) is a data exchange file which is used to send payment information of an enterprise to banks or tax authority. Basically these files … Dunning Procedures Configuration Step 1 : Access the transaction by using one the following navigation method SPRO > IMG > Financial Accounting (new) > Account receivable and Account payable > Business transactions > Dunning > Dunning procedure > Define Dunning Procedures.

SPRO > IMG >Financial Accounting > Accounts Receivable & Accounts Payable > Vendor Accounts > Master Data > Define Account Groups with Screen Layout (Vendors) Configuration Steps Step 1 : – Enter t-code “OBD3” in the SAP commend field and enter. 9/01/2013 · These are the following configuration steps for foreign currencies: 1. Check Currency Codes (SPRO) : SAP solutions come with standard currency codes for the ISO company codes. Sometimes circumstances arise in which you have to define new currency. You can do so through this step. 2. Set Decimal Places for Currencies (OY04) :In this step, you will define the number of …